It is likely old news to most insurance consumers that the National Flood Insurance Program (NFIP) administered by FEMA is plagued with challenges.

Challenges as in problems. Many. Big. Problems. This excellent New York Times article provides a sobering analysis of those problems.

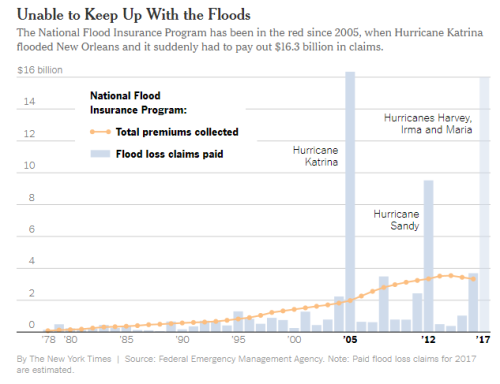

THE BIGGEST PROBLEM: As illustrated by the excellent chart below, although many policyholders feel their flood insurance premiums are already too high, the costs to pay all claims occurring in years with catastrophic flooding events GREATLY exceed the total premiums received over many years combined. The NFIP is not exactly a good business model.

SOLUTIONS ARE AVAILABLE: Consumers should be aware there are a number of private insurance carriers that provide alternative and/or supplemental coverage solutions to the National Flood Insurance Program. These private carriers can often provide expanded protection, cost improvements, and sometimes a combination of improved coverage and a lower cost.

WHERE TO FIND THEM: To evaluate private placement flood insurance solutions, insurance consumers should contact an independent insurance agent that represents multiple carriers. As with all forms of insurance, coverage terms and conditions vary among carriers, and established independent insurance agents are often able to help consumers explore multiple coverage solutions from different insurance carriers. I can help consumers in need of such assistance by providing a recommendation to local agencies located throughout the United States offering great expertise and market access.

As always, let the buyer BeAware!

Leave a comment